Tuesday, December 15, 2009

Tuesday, December 8, 2009

Saturday, December 5, 2009

REALTOR® Magazine-Daily News-30-Year Rates Hit Record Low

0 comments Posted by LaMar C Campbell at 10:19 AMREALTOR® Magazine-Daily News-Cities With the Most Overpriced Properties

0 comments Posted by LaMar C Campbell at 10:19 AMTuesday, December 1, 2009

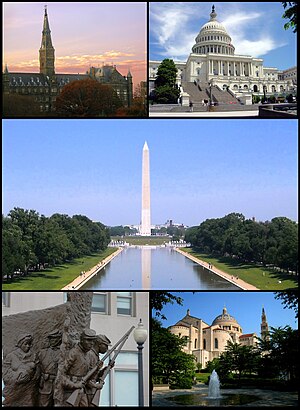

Image via Wikipedia

Image via Wikipedia

WASHINGTON (MarketWatch) - Signed sales contracts on existing homes in the United States rose for the ninth straight month in October, a real estate industry group reported Tuesday.

The pending home sales index rose a seasonally adjusted 3.7% in October from September, the National Association of Realtors reported. The index is up 31.8% compared with last October.

The index rose 6% in September.

AM Report: NBC's Future in View

WSJ's Sam Schechner breaks down the details of General Electic's tentative deal with Vivendi for control of NBC Universal. He talks with Neal Lipschutz and Bob O'Brien in the News Hub. Plus, WSJ's Matt Phillips on what's crossing the wires.

The index tracks sales contracts on pre-owned homes. Typically, it takes a month or two after the contract is signed for the sale to close. At that point, the sale is booked in the NAR's existing-home sales report.

The pending-home sales index has been running ahead of the existing-home sales figures, likely because tight credit conditions and tougher rules on appraisals are killing some deals before they close. Compared with a year ago, existing-home sales are up 23% to a seasonally adjusted annual rate of 6.1 million.

The federal government's first-time home-buyer tax credit could have led to more deals in October. The tax credit has now been extended, but buyers in October thought it would expire on Nov. 30.

Lawrence Yun, the chief economist for the real estate advocacy and lobbying group, said the increase in pending home sales wasn't entirely due to the tax credit. "Based on the demographics of our growing population, existing-home sales should be in the range of 5.5 million to 6.0 million annually," he said.

For 2010, the real estate agents expect sales of existing homes to rise 10.8% to 5.7 million compared with 5.15 million in 2009. New-home sales are projected to rise 42% in 2010 to 561,000 from 394,000 in 2009. Home prices are expected to rise about 4%, according to Yun's forecast.

REALTOR® Magazine-Daily News-Harvard Economist Predicts Prices Will Stay Low

0 comments Posted by LaMar C Campbell at 1:49 PMREALTOR® Magazine-Daily News-Parents Should Consider Homes as Gifts

0 comments Posted by LaMar C Campbell at 1:27 PMREALTOR® Magazine-Daily News-Treasury Plans to Push Banks to Modify Loans

0 comments Posted by LaMar C Campbell at 1:24 PMREALTOR® Magazine-Daily News-Wealthy Investors Are Eyeing Real Estate

0 comments Posted by LaMar C Campbell at 1:16 PM

This week on the Success of Real Estate Radio we want to take the time out to give back to the community, and we have the brain behind an event that we believe will take Atlanta by storm! We have back again to visit us Ms. Tracey Powell from the Atlanta Development Authority presenting a "Day Of Hope!" The Atlanta Development Authority is an integral part of the city of Atlanta. As the economic arm of the city of Atlanta, ADA has an awesome responsibility, and we can change lives for the better. As ADA’s Housing Finance Single Family Mortgage Specialist, I see how ADA makes a difference in people’s lives each and every day by issuing downpayment assistance to families and individuals purchasing homes in the Atlanta city limits. In some instances, we actually build personal relationships with the borrowers, our new city of Atlanta homeowners. We hear from the lenders and realtors, the non-profit homeownership educators, inspectors and attorney about how these programs are creating opportunities for people to change their lives. People are realizing the American Dream of homeownership, even in these tumultuous times. However, there are so many others that are unaware of the opportunities that are available and within their reach. So many people have given up on their dreams – it is time to reawaken those dreams through the power of knowledge. That is why we have created A Day of Hope.

Monday, November 30, 2009

Six Ways To Boost The Resale Value Of Your Home – Even In A Down Market

0 comments Posted by LaMar C Campbell at 10:37 AM Image by Sam Ilic Photography - STAGE88 via Flickr

Image by Sam Ilic Photography - STAGE88 via Flickr

Contributing Writer

Money Morning

It’s no secret that the old real estate adage tells us that only three things determine the value of your home – location, location, location.

But the reality is that there’s plenty you can do with most any piece of property to get a higher selling price in almost any market. Some of the steps you can take are largely cosmetic – and are aimed at improving the “curb appeal” of the property. Others involve extensive reconfigurations, making them costly.

Despite the big differences in both time involved and costs, almost all of these steps actually have a real return-on-investment (ROI). As the U.S. housing market slowly revives, and as the federal tax credit of $8,000 for first-time homebuyers is extended, it’s worth considering the projects you can launch that will boost the value of your humble abode.

A lot of money is at stake.

Homeowner spending on improvements more than doubled between 1995 and 2007 to reach $326 billion, according to a 2009 Harvard Joint Center for Housing Studies research study. More than three-quarters of that money was spent on what the Joint Center labels as “improvements,” with the rest going to maintenance and repairs.

In major metropolitan areas, individual homeowners spent between $3,400 and $4,000 a year. Now, in a tough real estate market, it’s time for these improvements to pay off. Just remember that you won’t necessarily recoup directly what you spend: just because you pour some $10,000 or $12,000 into, say, a Jacuzzi doesn’t mean you’ll get that much back in a sale price, say the experts. Improvements must be targeted to the things people want enough to pay for.

Some of the home improvements cost a lot less than you’d think. Consider some of the basic improvements you can take to make a house or condominium more attractive, more appealing and more saleable: Focus on turning your house in to a brighter, cleaner “postcard” that makes a huge first impression on a prospective buyer.

This includes simple exterior steps such as mowing the lawn, getting the garage cleaned up and removing eyesores from the driveway. Houses in even the most appealing upscale neighborhood have an old clunker that’s been under repair for months, a rusty gutter hanging down, or easy-to-eradicate eyesores like overgrown grass or weeds.

These may sound like simple tasks – in fact, they are – but some sellers are so focused on the interior that they forget that it’s not easy to get a buyer to come inside and look around and look if weeds, long grass and an under-restoration 1958 Ford Edsel are what they see from the curb.

Steve Berges, a real estate investment author who writes about increasing property values through home improvements, says its best to spend on the exterior first – specifically to induce prospective buyers to come inside and look around.

A View From the Curb

Stay on the outside and two opportunities present themselves:

* New windows.

* New siding.

* And a new roof.

New windows and new siding both have solid economic arguments in their favor.

For most homes, new windows are the fastest and easiest step to lower energy costs by making the house hold its shot or cool air more efficiently. They have an ROI that’s estimated at 77% to 80%, meaning you’ll get as much as 80 cents on the dollar back in the form of a higher price. (A federal tax credit of $1,500 also applies to the installation of new energy-efficient windows through next year.)

New windows are unique in that they’re one of the few improvements that provide benefits from both the outside and the inside.

Then there’s the siding, which can be replaced with either a fiber/cement or foam-backed vinyl substitute.

Although not every type of home is a candidate for new siding, and some people object to siding on aesthetic grounds, the ROI potential is strong here, as well. Energy efficiency has become a permanent part of the home-owner’s mindset, meaning it’s a key determinant in deciding the value of a home-improvement project, Remodeling magazine concluded in its most recent annual survey.

This all assumes, of course, that your roof is both in good shape and that it, too, looks good. Just remember that a bad roof, one that looks shabby even if it’s not, is a major part of the first impression that a house makes. Roof repairs can range in complexity from the replacement of a few shingles to replacement of the entire roof, gutters and soffits. The payoff here can come in the form of lower heating-and-cooling bills, the reduced risk of damage from leaks, and one less thing that a prospective buyer can use to negotiate down from the asking price.

Heart of the House

But houses are like people: the important stuff is inside, often deep inside. And it’s inside where the greatest costs and the greatest returns are to be found, says Northern Virginia Realtor Charlotte Jones. These are in the most important, most intimate parts of the house: The bathroom and the kitchen, the two places where the family function is core.

The kitchen is, after all, the ancestral hearth, where meals are shared. The bathroom, too, is important enough for its condition (as well as the number of bathrooms the house actually has) to affect the sale price of the home.

These two areas of the house can be approached as major rebuilds, or just as places to improve, says Northern Virginia home contractor Larry Sweeney.

Depending on the size and amenities of your desired bathroom, you could expect to pay $50,000 or more to tear out walls, repair joists and wall studs, change structural elements and make major layout changes, such as putting in a new shower and commode.

However big the price tag, you can still expect to recoup nearly 71% of the cost (which would be $36,400 if you have a $50,000 bill) when you go to sell. This project has increased in value since 2007, while its sister project – adding a complete bathroom – fell in value.

Kitchens are typically the most frequently used room in a home, so it makes sense that spending money here is going to pay off when it comes time to sell. Fancy cabinet work can be stunningly expensive, but new cabinetry improves appearances enormously. New floors or floor-coverings similarly can give a kitchen a whole new look.

Basic improvements to your kitchen can pay handsome dividends, says real-estate agent Michael C. Murphy in his book “How to Sell Your Home in Good or Bad Times.”

Murphy writes: “For most buyers, (the kitchen) is the heart of the house. Paint, wallpaper, and even re-floor the room if it needs it. Consider sanding, staining or painting worn-looking cabinets. Replace old cabinet hardware like handles and knobs – a low-cost improvement that makes a big difference in appearance.”

While a major kitchen renovation is usually the most time-consuming and expensive home improvement job (averaging more than $110,000), it’s also one of the most profitable. Regardless of the size of your financial layout, you can expect to get a nearly 71% ROI.

The average amount spent on a major kitchen-remodeling job is $55,503 for a midrange update; an upscale designer makeover averaged $109,394, according to Remodeling magazine. The mid-range kitchen overhaul nationally recouped 78% of its cost and 74% of the costs were recovered in an upscale makeover. If you want to keep your project from turning into a bottomless money pit, be extra careful in choosing the new appliances in an era of $6,000 refrigerators, make sure you choose carefully – getting what you really want and need.

Remember also that appliances are very much a personal choice, and a buyer’s taste may differ from yours.

Adding Room(s)

Many homeowners add an extra room if they’re in their house for a long time and raise their family there; the room is often for a child growing into his or her teen years. Not every home has the design or layout for an added room, which can easily exceed $100,000 in cost, but some people convert an attic or even a basement into living quarters for about half of that.

If you’re lucky enough to have a fair amount of land and space, an exterior deck is a way to extend your home’s room for living at a reasonable cost. With people spending more time at home – and entertaining there more, as well – an extra room or a large deck can be attractive investments.

Interestingly, pure wood decks have a lower value than an exterior deck made of a composite material of wood and another material. The price difference is as much as two and a half times for the composites. So you can spend anywhere from $10,000 to $25,00 – and up. Some homeowners spend more than $35,000, but claim that they recoup that investment. Geography, logically enough, plays a major role in determining the value of a deck addition, with exterior decking recouping much more in San Francisco than in, say, Columbus, Ohio, Remodeling says.

To close, here’s a brief note on some improvements that may seem very appealing, but which actually make little financial sense.

The big one is a swimming pool, which many people associate with upscale, luxurious living. But a pool not only adds little to a home’s resale value, it can actually pull it down: Pools require constant costly maintenance and, as they crack and age, those costs can escalate and accelerate. What’s more – in this age of hair-trigger litigation – a swimming pool can add the “fear factor” of legal liability.

As for the other, that fancy garden, it may seem upscale, but forget about it. Exterior gardens, especially an elegant estate-like topiary, add little or nothing to a home’s resale value.

By MARTIN CRUTSINGER (AP) – 2 hours ago

WASHINGTON — With the foreclosure crisis showing no signs of relenting, the Obama administration plans to expand a program aimed at helping people remain in their homes.

The goal of the announcement, expected Monday, is to increase the rate at which troubled home loans are converted into new loans with lower monthly payments, Treasury spokeswoman Meg Reilly said over the weekend.

Industry officials said the new effort would include increased pressure on mortgage companies to accelerate loan modifications by highlighting firms that are lagging in that area.

The Treasury is also expected to announce that it will wait until the loan modifications are permanent before paying cash incentives to mortgage companies that lower loan payments.

Under a $75 billion Treasury program, companies that agree to lower payments for troubled borrowers collect $1,000 initially from the government for each loan, followed by $1,000 annually for up to three years.

The government support, which is provided from the $700 billion financial bailout program, is aimed at providing cash incentives for mortgage providers to accept smaller mortgage payments rather than foreclosing on homes.

The program has come under heavy criticism for failing to do enough to attack a tidal wave of foreclosures. Analysts said the foreclosure crisis is likely to persist well into next year as high unemployment pushes more people out of their homes.

Rising foreclosures depress home prices and threaten the sustainability of the fledgling economic recovery.

A report last week from the Mortgage Bankers Association found that 14 percent of homeowners with mortgages were either behind on payments or in foreclosure at the end of September, a record level for the ninth straight quarter.

The Congressional Oversight Panel, a committee that monitors spending under Treasury's bailout program, concluded in a report last month that foreclosures are now threatening families who took out conventional, fixed-rate mortgages and put down payments of 10 to 20 percent on homes that would have been within their means in a normal market.

Treasury's program, known as the Home Affordable Modification Program, "is targeted at the housing crisis as it existed six months ago, rather than as it exists right now," the report said.

Treasury's Reilly said the expanded program would, among other steps, make more aid available to struggling borrowers and expand the number of organizations providing help.

Associated Press writer Jim Kuhnhenn contributed to this report.

Copyright © 2009 The Associated Press. All rights reserved.

Wealthy Investors Plan to Buy More Real Estate, Barclays Says

0 comments Posted by LaMar C Campbell at 10:29 AM

By Peter Woodifield

Nov. 30 (Bloomberg) -- Individuals with more than $800,000 to invest plan to increase their property holdings because they foresee better long-term returns than from stocks and bonds, according to a Barclays Plc global survey.

Twice as many people plan to raise their investment in commercial and residential property as intend to reduce it, the Barclays Wealth unit said in an e-mailed statement today. The richer the individual, the greater the proportion of wealth is placed in real estate, the survey found.

“I was surprised how big a share of their wealth property represents,” Mike Dicks, the London-based head of research at Barclays Wealth, said in an interview. “It’s not what I would tell grandma. None of our data suggests that would be a good allocation.”

The global recession pushed down commercial and residential real estate prices in every region except Asia. The value of U.S. shops, offices and warehouses fell 21 percent in the first three quarters of this year, following a 12 percent decline in 2008. Belief that properties are now undervalued was the second most common reason cited for increasing investment.

Real estate investment among wealthy individuals is set to rise to 30 percent of the average portfolio for the next few years from 28 percent now, according to the survey. That excludes properties used as a principal residence. Most rich people, other than the extremely wealthy, should have no more than 10 percent of their assets in property, said Dicks.

‘Emotional Attachment’

“An emotional attachment to bricks and mortar,” can mean that rich investors are often unwilling to sell real estate at short notice and may be less rigorous in measuring its performance as an asset, according to the report.

Investors from Canada and the Persian Gulf were the most likely to increase their property allocations, with an average rise of 4 percent, the report said. Spain was the only country in the survey where more individuals said they would reduce the proportion of real estate investment, said the wealth management division of London-based Barclays. About 60 percent of rich individuals in that country have more than half their assets in property.

Almost 30 percent of British and Indian investors have more than half their wealth tied up in real estate. About 40 percent of the total respondents worth more than 30 million pounds ($49 million) have a similar allocation, Barclays Wealth said.

U.S. Attractive

Three out of four investors surveyed said residential property is looking attractive and two-thirds are keen to explore investing in commercial real estate, the survey said. About 75 percent said they feel hampered by borrowing costs.

The U.S. was the most attractive real estate market for investors outside their home country, the survey showed. The country was seen as having the highest potential for return on investment.

Barclays Wealth surveyed 2,000 people. Forty percent were worth 500,000 pounds to 1 million pounds. An additional 40 percent were worth between 1 million pounds and 10 million pounds. Ten percent had assets of as much as 30 million pounds and the rest were wealthier than that.

To contact the reporter on this story: Peter Woodifield in Edinburgh at pwoodifield@bloomberg.net.

Image by Getty Images via Daylife

Image by Getty Images via Daylife

WASHINGTON -- Sales of new homes rose 6.2 percent in October on strong results in the South, the Commerce Department estimated Wednesday.

The rise in U.S. new-home sales to a seasonally adjusted annual rate of 430,000 was well above the 390,000 pace that economists surveyed by MarketWatch had expected.

Sales rose 23.2 percent in the South. By contrast, monthly sales fell by 20 percent in the Midwest, and by 5.1 percent in both the Northeast and the West.

New Home Sales

A development of new homes is shown in Homestead, Fla. Sales of new homes rose more than expected last month to the highest level in more than a year as the housing market shows stability after its historic collapse.

"On the surface, one would have assumed that the surge in sales activity was induced by the rush of first-time home buyers trying to get ahead of the originally scheduled end of the first-time homebuyers' tax credit at the end of October," wrote Millan Mulraine, economics strategist with TDSecurities, in a research note. "However, given the lopsided regional dimension to the increase in home sales we are not entirely convinced that this was the only story."

The government cautions that its housing data are subject to large sampling and other statistical errors, with large revisions common. It can take up to six months for a trend in sales to emerge.

The pace of new-home sales in September also was revised slightly higher, to a level of 405,000. New-home sales are up 5.1 percent compared with a year ago, the government's data showed.

The supply of homes on the market fell to 239,000 in October, representing a 6.7-month supply.

The median sales price in October hit $212,200, compared with $213,200 in the prior year.

Consumer Confidence in U.S. Unexpectedly Increased

0 comments Posted by LaMar C Campbell at 10:20 AM Image via CrunchBase

Image via CrunchBase

By Bob Willis

Nov. 24 (Bloomberg) -- Confidence among U.S. consumers unexpectedly rose in November as a brightening outlook masked growing concern over joblessness.

The Conference Board’s confidence index increased to 49.5 from 48.7 the prior month. The New York-based Conference Board’s index, which focuses on the labor market and purchase plans, averaged 58 in 2008 and 103.4 in 2007.

The report showed Americans fretted over jobs, signaling the highest unemployment rate in 26 years may restrain spending and limit the recovery from the worst recession since the 1930s. Target Corp. last week said it remains cautious about sales this quarter and expects to offer incentives spur holiday shopping.

“Labor market perceptions are very weak,” said David Sloan, chief U.S. economist at 4Cast Inc. in New York, who forecast an increase in confidence. “What did drive is up was expectations, optimism that things will get better, not that things have gotten better.”

Other reports today showed home prices rose and the economy grew at a slower pace last quarter as consumer spending climbed less than the government previously estimated.

Stocks Fall

Stocks dropped following the reports on concern over the outlook for household purchases. The Standard & Poor’s 500 Index fell 0.6 percent to 1,099.45 at 10:23 a.m. in New York.

Federal Reserve Chairman Ben S. Bernanke last week said joblessness and limited bank lending were “headwinds” for the economy.

Economists forecast confidence would decrease to 47.3 from a previously reported 47.7 for October, according to the median of 74 projections in a Bloomberg News survey. Estimates ranged from 40.7 to 53.

The S&P/Case-Shiller home-price index of 20 U.S. cities increased 0.3 percent in September from the prior month on a seasonally adjusted basis after a 1.1 percent rise in August, the group said today in New York. The gauge fell 9.4 percent from September 2008, the smallest year-over-year decline since the end of 2007.

The world’s largest economy expanded at a 2.8 percent annual rate in the third quarter, down from the 3.5 percent pace estimated last month, the Commerce Department reported today. The figures also showed corporate profits climbed 10.6 percent, the most in five years.

Job Concerns

The Conference Board’s measure of present conditions decreased to 21, the lowest level in 26 years, from 21.1 the prior month. The decrease reflected growing concern over unemployment with a measure of job availability reaching the lowest level since 1983.

The share of consumers who said jobs are plentiful fell to 3.2 percent from 3.5 percent, according to the Conference Board. The proportion of people who said jobs are hard to get increased to 49.8 percent from 49.4 percent.

The gauge of expectations for the next six months climbed to 68.5 from 67 the prior month.

The proportion of people who expect their incomes to rise over the next six months decreased to 10 percent from 10.7 percent. The share expecting more jobs dropped to 15.2 percent from 16.8 percent.

Buying plans for automobiles and real estate dropped this month, the report showed. Home-buying expectations decreased to the lowest level since 1982.

Less Income

“Income expectations remain very pessimistic and consumers are entering the holiday season in a very frugal mood,” Lynn Franco, director of the Conference Board’s Consumer Research Center, said in a statement.

The U.S. has lost 7.3 million jobs since the recession began in December 2007 and more losses are forthcoming. Goldman Sachs Group Inc. chief U.S. economist Jan Hatzius forecast earlier this month that unemployment would average 10.4 percent next year.

Citing the labor market as an “area of great concern,” Bernanke last week told the Economic Club of New York that “jobs are likely to remain scarce for some time, keeping households cautious about spending,”

AOL, the Internet unit being spun off from Time Warner Inc. in December, plans to cut about one-third of its 6,900 employees over the next several months. The company will begin a voluntary layoff program Dec. 4 and said it’s looking for as many as 2,500 volunteers, AOL spokeswoman Tricia Primrose said in an e-mail last week. The company will make up the shortfall of volunteers through firings, she said.

Smaller Purchases

Saks Inc., the U.S. luxury retail chain, and Target, the second-largest discount chain, last week said they remain cautious about demand after reporting third-quarter earnings that beat analysts’ estimates. Target said average transaction sizes shrank in November and fourth-quarter comparable-store sales may fall after third-quarter earnings rose more than analysts projected.

Target expects a “highly promotional” holiday season, Chairman and Chief Executive Officer Gregg Steinhafel said on a conference call. November sales “provide additional justification for being cautious in this uncertain environment,” he said.

Lending rates near record lows and government incentives such as “cash for clunkers” and first-time homebuyer credits have helped spur purchases of cars and houses in recent months.

To contact the reporter on this story: Bob Willis in Washington bwillis@bloomberg.net

Last Updated: November 24, 2009 10:25 EST

How much house can you get these days for $80,000?

I started thinking about this a few weeks ago, when Congress extended and expanded the refundable tax credit for homebuyers.

With the credit, buyers can get back 10% of the purchase cost on a home -- up to $6,500 for many who currently own a home, and $8,000 for qualifying first-time buyers. In the season of gift-giving, it's a wonderful present from taxpayers to home shoppers.

Do the math: The best return goes to the first-time buyer who spends 80 grand and gets 10% back. But if you spend, say, $300,000, you still only get the $8,000 – a measly 2%.

So what can you get for $80,000?

In the vast areas in the middle of the country, where space is not really a major constraint on housing, it can go a long way. Obvious point: Many of the cheapest places to buy are cheap for good reason. The neighborhoods may be depressed or worse. Good jobs—any job--may be hard to find.

The National Association of Realtors tags Saginaw, Mich., as the metropolitan statistical area with the cheapest real estate in the country. Median price of a single family home: $61,000. So in Saginaw the full $80,000 will take you upscale. Zillow features this three bedroom, two bath house (1,266 square feet) for $34,900.

At the other end of the range stands the San Francisco Bay Area, where median prices are more than half a million bucks. What does the $8,000 tax credit get you? "It doesn't do much for us here," admits James Caldwell, manager of Prudential California Realty on Union Street in San Francisco.

When I pressed him, Mr. Caldwell said you could get a one-bedroom condo in some cheap but OK areas just outside the city, like Pacifica, for maybe $200,000 or so. An $8,000 credit will at least cover 4% of the costs.

Over the bridge in Oakland you can get something even cheaper.

Real estate Web site Trulia illustrates the range of options in: Cleveland, Dallas, Detroit, Ft. Lauderdale, Fla., Las Vegas, Oakland, Calif., Oklahoma City, Ok., and Tulsa, Ok. See the photos at left for some details.

One obvious standout: Las Vegas, essentially ground zero for the real estate collapse. For $80,000, notes Trulia, you can get a four bedroom, two and a half bathroom house with 1,600 square feet. It is, of course, pure coincidence that Senate Majority Leader Harry Reid (D.-Nev), who faces a tough re-election battle in the state next year, championed the extension of the tax credits.

The other big beneficiary of tax credit stimulus, of course, is over the border in Arizona, where home prices have taken a major haircut since the bubble popped.

Real estate Web site Zillow reports about 450 homes in Phoenix's Maricopa County, Ariz., for sale between $75,000 and $80,000. Spokeswoman Katie Curnutte says "three quarters have at least three bedrooms, and one quarter has at least four."

The comparable figure for Las Vegas was still impressive: 237 homes between $75,000 and $80,000.

But in San Bernardino, Calif., the figure was just 34 and in New York City you'd be laughed out of town.

Looking to make the most of your tax credit? Go west, young man.

Write to Brett Arends at brett.arends@wsj.com

A Look at Case-Shiller, by Metro Area (November Update)

0 comments Posted by LaMar C Campbell at 10:09 AM

By Phil Izzo

The S&P/Case-Shiller 20-city home-price index, a closely watched gauge of U.S. home prices, rose 0.3% in September from August in the fifth straight monthly increase, as prices gains slowed and remain below year-earlier levels.

For the 18th straight month, no area in the 20-city index posted a year-over-year price gain. September also marks the quarterly release of the broader National Home Price Index, which posted its second consecutive quarterly increase though it remains 8.9% lower than a year earlier.

“The gains in the most recent month are more modest than during the seasonally strong summer months. Fewer cities saw month to month improvements in September than in August in both seasonally adjusted and unadjusted figures,” said David M. Blitzer, chairman of the Index Committee at Standard & Poor’s.

Analyst Dan Grenhaus of Miller Tabak + Co. said now that evidence of a bottom is clear, the question is what happens now. “The issue going forward relates to how far prices can accelerate given the inventory overhang, level of shadow inventory, continued foreclosures, persistently high unemployment rate and tighter credit standards which require greater down payments and higher FICO scores (as well as removing one’s ability to simply assert they make “X” dollars without proving it),” he said.

Just 10 of the 20 areas saw monthly price gains in September, that’s down from 17 gainers in August. Minneapolis posted the strongest monthly increase at 1.8%, and hard-hit Detroit also managed a 1.8% monthly gain.

Cleveland fared the worst for September with a 1.6% monthly decline, but prices there are only down 3.7% from a year earlier. Las Vegas and Phoenix continue to see annual declines in excess of 20%.

* See the full S&P/Case-Shiller report.

* Read the full story.

Below, see data from the 20 metro areas Case-Shiller tracks, sortable by name, level, monthly change and year-over-year change — just click the column headers to re-sort.

(About the numbers: The Case Shiller indices have a base value of 100 in January 2000. So a current index value of 150 translates to a 50% appreciation rate since January 2000 for a typical home located within the metro market.)

Home Prices, by Metro Area

Metro Area September 2009 Change from August Year-over-year change

Atlanta 111.26 0.0% -9.3%

Boston 155.62 -0.2% -3.3%

Charlotte 119.84 -0.7% -8.1%

Chicago 132.13 1.2% -10.6%

Cleveland 105.75 -1.6% -3.7%

Dallas 120.57 -0.7% -1.2%

Denver 129.45 -0.5% -1.2%

Detroit 72.9 1.8% -19.2%

Las Vegas 104.82 -0.9% -28.6%

Los Angeles 167.93 0.8% -9.0%

Miami 149.69 0.5% -16.2%

Minneapolis 124.96 1.8% -11.2%

New York 174.38 -0.3% -9.0%

Phoenix 109.26 0.8% -21.8%

Portland 149.72 -0.5% -11.8%

San Diego 154.76 0.9% -5.7%

San Francisco 134.16 1.3% -7.8%

Seattle 148.94 -0.4% -13.8%

Tampa 142.57 -0.6% -16.7%

Washington 180.45 0.5% -5.0%

Source: Standard & Poor’s and FiservData

By Lisa Gibbs, Money Magazine senior writer

Harvard economist Edward Glaeser studies the forces that make some regions thrive and others die ... and what that has to do with the weather in January.

(Money Magazine) -- Since the crash, we've gotten used to thinking of real estate as a market shaped by national forces: Interest rates went down, Wall Street and homebuyers went nuts, regulators fell asleep at the switch, and -- voilà -- we had ourselves a bubble.

But Edward Glaeser, an economist at Harvard University, finds that real estate is still a local business driven by local conditions. In studying the rise of the Sunbelt, Glaeser has found that winter temperatures were one of the best predictors of a region's population growth, but that this has as much to do with regulations as sunshine.

He's stirred controversy by arguing that many "older, colder" cities will never roar back. (By the way, he'd like to scale back the tax break you get on your mortgage too.) Senior writer Lisa Gibbs spoke with Glaeser about what really drives real estate markets, and what that means for prices; edited excerpts follow.

First, let's talk about the big question on everyone's mind. Where do you see real estate going from here?

There are two basic approaches to thinking about this. One is looking at past price patterns, like the long-run tendency to give back price gains and the short-run tendency for prices to have momentum -- that is, to keep moving in the same direction. We've now given up at least a third of the previous gains, and the recent price changes have been positive. From that perspective, it looks like we're close to having hit bottom.

The other approach is to ask, What is the supply and demand? That approach is easiest to use in Sunbelt cities like Phoenix and Las Vegas, where you basically have unrestricted supply.

The price of a home should be the cost of construction plus land plus reasonable developer profit. We're getting there, but it wouldn't be crazy to see more declines just because there was so much overbuilding. The same is true for the Miami condo market, where there were no constraints on building up.

Those places are still growing, though. You've found that January temperatures can predict a region's population growth. So how did those nice warm cities get hit so hard by the crash?

Let's step back a bit. When we talk about the long-term growth of the Sunbelt, it is partly about the demand for housing. The first generation of booming American cities, like Detroit and New York, was built around waterways because of the enormous advantages of moving goods by water. Before the railroads, it cost more to move goods 32 miles over land than to cross the Atlantic Ocean. The big change of the 20th century was the decline of transportation costs. Industry moved, and with that came the rise of cities built where people wanted to live. The rise of California's cities is the first great example of this.

People just followed the weather?

Not exactly. The other part of the story is the supply of housing. In the 1970s in California, a variety of constraints were put on development. Some were wise, some were not, but they made it increasingly difficult to build. Other areas -- Atlanta, Dallas, Houston, and Phoenix -- may have had a less vibrant economy and less comfortable summer temperature, but they had a building environment that could not have been more lenient. Developers built a vast amount of housing that was incredibly affordable.

So low prices actually help drive a lot of the growth. Does that mean you won't necessarily make a lot of money on real estate when an area is booming?

Healthy population growth does not imply that prices will always go up at all. A good climate and a robust economy tend to push housing prices up, but meanwhile an elastic housing supply keeps prices moderate. If housing supply outstrips demand, prices can fall.

And that's what happened in the Sunbelt after 2000.

The bubble hit the Sunbelt in different ways. Dallas basically had no big price increase during the boom and no bust. That's what you expect in a place that had no constraints on building. I would have thought the same logic should have held in Vegas. But perhaps because of Las Vegas's proximity to California, people thought it would become like California. That was belied by the huge amount of building going on.

The harsh reality is that real estate prices that go up come down. I've found that for every real $1 increase in local market prices over a five-year period, prices go down 32¢ over the following five years.

What should the government be doing to stabilize the U.S. housing market?

It's not the job of government to make housing more expensive. Its job is to get rid of distortions in the market that make housing too expensive.

The government has set up an $8,000 tax credit for buyers, which was motivated to push prices up. I'm not crazy about more subsidies for homebuying, but I don't think tax credits would necessarily be such a terrible thing -- especially if you could use them to reform the mortgage-interest tax deduction.

What's wrong with the mortgage-interest deduction?

It's very strangely designed. If the goal were to encourage homeownership, you'd want to target the people on the margin between renting and buying, people early in their lives. But because a tax deduction is worth more to higher earners, we have a policy that gives 10 times more benefits to Americans earning more than $250,000 than to households earning less than $75,000. It's an enormously regressive policy. And its benefit rises with the size of the house and the debt you take on. Why should the government be complicit in urging people to buy larger homes?

Can something so popular actually be taken away?

A not-so-politically-impossible fix would be to lower the cap on what's deductible, currently $1 million of mortgage debt. Reducing it to between $200,000 and $250,000 would eliminate the most regressive aspects of the tax, and it wouldn't touch the majority of Americans. And do it over time, given the delicate condition of the housing market. Ideally you'd get rid of the deduction and replace it with a buyer tax credit. If you want a pro-homeownership incentive, keep it small, keep it targeted.

What's the role of property taxes in the real estate market?

In places that have completely screwed up their assessment processes, like California with its Proposition 13 that freezes assessments, you're creating an incentive for people not to move.

Many places are going to have big fights over those assessments this year, given how much prices have dropped.

We are seeing these fights over assessments because there's a lot of uncertainty over what houses are worth. We could move toward a system where assessments are tied to benchmarks like the Case-Shiller index. Then we don't have to waste countless hours arguing.

The broader issue is that many places are highly dependent on taxes from assets, which has made paying for government harder. Boston is at 8.4% unemployment -- bad, but not Armageddon. But the perspective from the state government is awful because of the precipitous decline in tax revenue.

I was recently in Detroit, where I saw a decent house sell for $6,900. Can Detroit and other industrial cities come back?

Detroit can make itself a more livable, comfortable city and make life better for children growing up there. The mistake is to try to attain some long-held ideal about what Detroit once was. It probably needs to shrink: Focus on which abandoned neighborhoods can be torn down and replaced with more productive space. And consolidate services. Detroit is fascinating, beautiful, and challenging. I recently visited Detroit Dry Docks, one of the places Ford got its start. It's now an empty hulk.

That's the story behind your $6,900 house. This was a city that was one of the most productive on the planet, and they built housing and infrastructure accordingly. Even though the business leaves, the houses and infrastructure remain. To top of page

Housing, Profits, Confidence: The Economic Mending Continues

0 comments Posted by LaMar C Campbell at 9:27 AM Image via Wikipedia

Image via Wikipedia

Recent days have seen continued rebounds in housing, corporate profit reports and consumer confidence.

Two reports early this week point to continued progress in residential housing resales. On Monday the National Association of Realtors implied that the home-buyer tax credit will likely sustain the housing market throughout next year. In October, first-time buyers used the tax credit and combined it with record low mortgage rates to push home sales to their highest level in 2 1/2 years. Home sales are now 37 percent above their bottom in January and the seven-month supply of inventory is quite modest. We saw bidding wars break out earlier this year in select areas, but now those competitions are becoming more widespread.

On Tuesday, home prices continued to show improvement according to the Case-Shiller report. The report data continued a long strong string of improvements: Year-on-year rates continue to improve; quarter-to-quarter rate shows steady improvement and those areas that were especially hit hard like the West and pockets of Florida have turned markedly higher.

An analysis of corporate profits is also quite rosy. Tuesday's government release shed light on huge corporate profits: up 16% since the end of last year. What is particularly noteworthy is that even though we've just made it through a strong recession, profits in US firms have essentially doubled in the past 8 years.

And a consumer confidence report out on Monday took everyone by surprise. Heading into the holiday season, consumer confidence is back on the rise. The Conference Board consumer confidence index rose to a level not forecast by even the most optimistic forecasters. Most had expected a downturn in confidence.

Monday, November 23, 2009

This week on The Success of Real Estate Radio we have the pleasure of having Ms. Joyce Mann.Joyce is an Independent Agent in the Credit Restoration industry. She’s part of a champion marketing team; VR-Tech’s “Dream Team Worldwide.” Where they offer business opportunities to enroll customers into a qualified program with United Credit Education Service, a company that uses state-of-the-art technology to help people restore, establish and protect their credit. Joyce received her BA in Finance from Clark Atlanta University. Her financial background has spanned from collections to investment banking to entrepreneurship. She’s been a licensed financial professional for over 15 years. She currently holds a series 7 & series 63 stock broker license; as well as, Life & Variable insurance license. She began conducting retirement seminars in the year 2000 and she started building her credit and financial education network in 2007. Throughout life, Joyce has achieved many accomplishments and has received many awards & recognition. Some of her recent accomplishments include: * The “DTU-Billionaires Philosophy Diploma” * Diamond Life member of Delta Sigma Theta Sorority, Inc * Chair person of the Economic Development committee for Douglas-Carroll-Paulding chapter of ?ST. * 5 Star-High Ranking Presenter; * Certificate of Success for Group Seminar Training * Certificate of Appreciation for Quality Improvement * The World Who’s-Who of Women * 2000 Notable American Women Joyce Mann’s crusade is to: SHARE opportunities for financial freedom; EMPOWER people with useful financial information and ENCOURAGE people to take action; NOW! You won't want to miss this show!!

Thursday, November 19, 2009

Image via Wikipedia

Image via Wikipedia

The huge impact of the federal home buyer tax credit program, which is now set to continue and even expand through next spring, dominates the housing resale numbers this week.

Sales of existing houses during the third quarter jumped by 11.4 percent over second quarter sales, according to the National Association of Realtors.

And the increase in sales came in pretty much every part of the country -- in 45 states along with the District of Columbia.

Check out some of these extraordinary increases -- all tied in part to home buyers rushing to complete purchase transactions before the tax credit's original expiration date of November 30th, plus mortgages at rock bottom five percent rates or less.

In North Dakota, sales were up 42.4 percent, Rhode Island 27 percent, Pennsylvania 26 percent.

In some hard hit local markets, sales gains were almost off the charts. In Orlando, they were up 80 percent for the quarter. In Las Vegas sales were 30 percent higher this year over last.

So do you think things are stirring out there? You bet they are, and economists haven't yet even begun to assess the potential effects on future sales flowing from the brand new $6,500 tax credit for "repeat" buyers.

That means people who've owned their house for a consecutive five of the previous eight years, and now want to downsize, move up or just move to a different location.

That credit, which took effect November 6th, will be available for home purchase contracts signed by April 30th of next year and closed by June 30th.

Of course, not all of the developments underway in the economy right now are favorable to housing and real estate.

Start with the unemployment rate, which just jumped to 10.2 percent, the highest in decades. Most economists agree that the true jobless rate, factoring in people who've stopped looking for jobs and those working part time, takes the effective unemployment rate nationally closer to 18 percent.

That's a major negative for home buying prospects.

And the flip side of record housing sales numbers can't be ignored either: Prices are still way down from year ago levels in many areas -- and they're down 11 percent during the third quarter compared with 2008.

So that's all pretty sobering.

Nonetheless the fact is that the only way we're going to move towards full recovery is by selling a lot of houses, at very attractive prices and low interest rates.

That's happening right now in a big way -- and it looks like it should continue well into the spring.

Low Interest Rates Spur Refinancing, Buying Interest

0 comments Posted by LaMar C Campbell at 11:15 AM Image via Wikipedia

Image via Wikipedia

If you purchased a home a year ago and have the equity and creditworthiness to swing it, a refinance today could save you hundreds of dollars a month.

Or, if you are in the market to buy a home, interest rates will make for a more affordable deal.

Freddie Mac's Primary Mortgage Market Survey for Nov. 12 put the average fixed interest rate for 30-year conforming mortgages at 4.91 percent.

Last year at the same time, the 30-year fixed rate mortgage (FRM) averaged 6.14 percent.

"Keeping rates at historically low levels for a sustained period of time has to remain a cornerstone of Fed policy until the economy gets back on track," said Nancy Osborne, chief operating officer of Erate.com.

On a $300,000 mortgage the principle and interest payment at today's average rate would be about $1,594, compared to $1,825 a year ago, according to Erate's calculators.

That's a monthly savings of $231. Put another way, a year's worth of the savings -- $2,772 -- amounts to almost two mortgage payments on a $300,000 mortgage at today's average rate.

Both home buyers and owners who want to refinance may have some time yet to shop around and dicker for the best interest rate deal.

"I don't suspect rates will begin to rise until we see at least three consecutive months of solid employment growth," Osborne said.

Freddie Mac also said the 15-year FRM averaged 4.36 percent, down from 5.81 percent a year ago.

Image via Wikipedia

Image via Wikipedia

Mortgage rates dropped to a historic low, but hardly anyone is getting a home loan.

The benchmark 30-year fixed-rate mortgage fell 13 basis points, to 5.06 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point.

That's the lowest rate on the 30-year fixed in the 24-year history of Bankrate's weekly mortgage index. Previously, the all-time low had been 5.13 percent, on April 1 this year. (In case you're wondering, the highest was 12.31 percent -- in the first-ever survey, conducted Sept. 25, 1985.)

The mortgages in this week's survey had an average total of 0.4 discount and origination points. One year ago, the mortgage index was 6.33 percent; four weeks ago, it was 5.34 percent.

The benchmark 15-year fixed-rate mortgage fell 13 basis points, to 4.48 percent. That, too, is a record low. The benchmark 5/1 adjustable-rate mortgage was unchanged, at 4.58 percent. That's a record low dating back to when Bankrate started collecting 5/1 ARM rates at the beginning of 2005. And the benchmark 30-year fixed jumbo fell 29 basis points, to 5.95 percent. It was 5.6 percent in June 2003.

Despite the low rates, fewer homebuyers applied for mortgages last week than at any time since November 1997, according to the Mortgage Bankers Association. The MBA's purchase application index has fallen six weeks in a row to settle at that 12-year nadir.

Weekly national mortgage survey

Results of Bankrate.com's Nov. 19, 2009, weekly national survey of large lenders and the effect on monthly payments for a $165,000 loan:

30-year fixed 15-year fixed 5-year ARM

This week's rate: 5.06% 4.48% 4.58%

Change from last week: -0.13 -0.13 N/C

Monthly payment: $891.82 $1,260.55 $843.89

Change from last week: -$13.19 -$10.98 N/C

When you ask why there has been a collapse in homebuyer mortgage applications (and, you would assume, home purchases), one culprit comes to mind instantly: the first-time homebuyer tax credit. A couple of weeks ago, Congress extended the tax credit into next spring. But before that extension, the tax credit had been scheduled to expire Nov. 30. And to take possession of their homes by that date, mortgage borrowers had to sign purchase contracts by the end of October at the latest.

If people rushed to buy homes in October instead of making offers in November, it seems perfectly natural that there would be a lull in homebuying now. So will the homebuying spree resume now that the tax credit has been extended? Not necessarily. People in the mortgage industry are becoming gloomy, and they aren't counting on a surge of homebuyers.

Dick Lepre, senior loan consultant for Residential Pacific Mortgage in San Francisco, says that in the last six months, three of his clients lost jobs in the middle of the loan process. "Some of the downturn in applications is related to unemployment," he says.

Another factor that depresses mortgage borrowing: disrepair. Foreclosed homes are "selling for all-cash because the condition of the property is such that they cannot qualify for a loan," Lepre says. In other words, there's a chunk of houses that are available only to cash buyers and not to those of us who have to borrow.

On the other side of the country, "purchase business still seems to be flowing. But people are only willing to pay rock-bottom prices," says Brian Peart. Peart, president of Nexus Financial Group, a mortgage brokerage in Atlanta, says he sees "downward pressure on (house) prices for many years to come" because of rising foreclosures and unemployment.

Waiting for the 'urgent call'?

Just about everyone in the mortgage business expects rates to rise over the next four months, as the Federal Reserve winds up its purchases of more than a trillion dollars in mortgage-backed securities and investors take up the slack. The thinking goes that private investors will demand higher interest rates on mortgages than the Fed requires.

Barry Habib, publisher of Mortgage Market Guide, an industry online publication, expects rates to rise in "stepladder" fashion from around now through March. Rising rates, he believes, will provoke more homebuying. Right now, he says, there's no "urgent call" to buy houses because rates have remained so low for months.

"In the absence of an urgent call, people are focusing on Thanksgiving plans and holiday shopping and their lives," Habib says. "But as soon as rates go up, people will get out there and say, 'I'd like to purchase or refinance.'"

Habib's point sounds counterintuitive, but experience backs him up. Throughout this decade, there has been a spike in mortgage applications whenever rates have abruptly risen after remaining fairly steady for a while. It's human nature, Habib says, for borrowers to jump off the fence when rates rise. Hardly anyone gets a loan at the lowest rate in the cycle; people get loans at slightly higher rates once it becomes clear that rates have bottomed out and are heading back up.

Habib believes that home sales will increase in the spring, and rising rates will be a bigger reason than the expiration of the homebuyer tax credits.

But buyers should be cautious, Lepre warns: "The only people who really, really should be buying are a couple who have steady employment and see an opportunity to buy a home for much less than they could three years ago," he says.

If you're in the market for a mortgage or refinance, you can look for the best interest rate by searching Bankrate's rate tables.

Tuesday, November 17, 2009

The week on Success in Real Estate Radio we will have the Honor of having Mr. Jeffery Hicks, President of the Empire Board of Realtists. Today we will visit the History of the Empire Board of Realtist INc and the History, Legacy , and the constant community presence this orginization continues to provide for the community.The Empire Real Estate Board, Inc. (EREB), was organized in 1939 by seven black Real Estate Brokers who were dissatisfied with "status quo" relating to housing conditions in Atlanta for Blacks. Additionally, they were unhappy with the conditions for Black real estate practitioners and were denied membership in the Realtors' trade organization. The pioneers were: W. H. Aiken, John G. Allen, O. T. Bell, Wendell Cunningham, Roger Henderson, J. R. Wilson, Jr. and N. D. Jones. So make sure you tune in for a quick update on the Tax Credit as well other top headline over the past week! You won't want to miss this show!

Monday, November 16, 2009

Image via Wikipedia

Image via Wikipedia

This post is geared for newbies, as well as homebuying veterans who may need a brushup on the basics. Most of these tips come from Eric Bramlett, a real estate broker out of Austin, Texas.

1) Decide whether it's time to move.

Weigh the cost versus the benefit. Are you planning to stay for at least three years in your new home? If your answer is ‘yes’ then you should go ahead and buy. You will be at a break-even on your closing costs after two years and start making money at year three.

2) Home = Money Machine.

After year three, you can really experience the benefits of appreciation.

3) The first step - Pre-approval

Get pre-approved for a loan. This is the scariest part for many buyers, but pre-approval is a very important step. Pre-approval gives you buying power and allows you to make a solid offer on your dream home when you’ve found it. A pre-approval letter also makes the seller more likely to accept your offer.

4) Learn your total housing costs

Pre-approval also lets you know how much your new home will REALLY cost—in monthly payments. A $650,000 or $800,000 home price can be an abstract concept, but $3,000 a month or $4,500 a month are tangibles that everyone can understand. When you meet with a lending professional (call me at 415-577-0809 for the names of some great ones) ask them for a “payment table” that shows you a rough estimate of your TOTAL monthly payment, including taxes and insurance or homeowners fees based on purchase price. Pick your payment and you know the price range to shop in.

5) Call a good Realtor

I know this sounds self-serving, especially when you can find just about every home for sale online, but a good agent will take the spam out of your property showings. I also make it my business to track the market 24/7 and take pride in putting my buyers into carefully selected properties that will hold their value in the short term and offer excellent appreciation in the long term.

6) Hang tough on negotiating terms and price

I’ll also go to the mat for you when negotiating price and terms to make sure you don’t overpay and protect your interests. With the average real estate file running 100 pages or more, one tiny mistake or omission could land you in court or cost you thousands. Having a Realtor handle the paperwork not only eliminates the headache, it also limits your financial and legal risk.

7) The “wants and needs in a home” exercise

Make a list of “Must Haves” and “Wants.” Your search will be easier and you’ll be more confident in your decision if you take a systematic approach. The best way is to make two lists: Your “must haves” and your “wants.” Your “must haves” are the essentials: parking, bedroom/bath count, square footage and the unique odds and ends like room for your kayak or big walls for your art. Your “wants” are the qualities that you would like for your new home to have, but can live without. Great examples of “wants” are hardwood floors, a gas stove, and type of exterior. By taking the time to articulate what you need and want in your new home, you will know exactly what to look for when looking at prospective homes.

8) Figure out the best neighborhoods for your needs

Learn the neighborhoods. The variety of home styles and neighborhoods is astonishing in San Francisco. You can buy a mid-century house in Midtown Terrace, an Edwardian flat in the Western Addition or a sleek apartment condo in South Beach. Sometimes I like to put my buyers in a car and drive the neighborhoods. It gives them an opportunity to learn some of the City’s geography and get a feel for the different areas. You can also read about San Francisco neighborhoods on my website.

San Francisco also has micro-neighborhoods, where housing styles and neighborhood character change within the space of just a few blocks. The 700 block of Waller is vastly different from the 300 block, for example. Weather is also a big consideration. If you’re a sun worshipper, some neighborhoods, like the Outer Sunset, are out of the question.

9) Be a buyer, not a browser

Beware of the “Red Shoe Experience.” This tip comes from Elizabeth Weintraub, of Lyon’s Realty in Sacramento. Women will relate to this. Say, you need a new pair of red shoes. You go to the mall. At the first shoe store, you find a fabulous pair of red shoes. You try them on. They fit perfectly. They are glamorous. Priced right, too. Do you buy them? Of course not! You go to every other store in the mall trying on red shoes until you are ready to drop from exhaustion. Then you return to the first store and the red shoes are gone. Do not shop for a home this way. When you find the perfect home, buy it.

10) Make your decision!

This tip is a corollary to the Red Shoe Experience. Homebuyers often hesitate after they’ve found the right home because they’re not confident about their decision-making process. Your home is probably the largest investment of your life, and it’s normal to feel those butterflies. However, if you have followed the steps above, you will have your bases covered. If you’ve found a home that meets all of your “must haves,” most of your “wants,” is in the right neighborhood, and in your budget - it’s the one for you! Don’t wait and let another buyer take YOUR home!

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=beaa8f90-7c1d-4207-90e6-7faf01f1a7ca)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b8aab7ab-070f-4d6d-9918-c6b6669aec31)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=2f7aa91f-ad25-44ff-9bde-2f3dc1badb4c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=301785a0-9eee-479d-91ea-2e421d051388)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=fb123a5e-ec29-45cd-9bff-3f99c173fd8a)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=7f446cbe-42e9-4d84-938a-edf2adf8add7)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=b5fcc26f-445a-465d-863b-716713cf03fd)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=12ace50a-5ff5-4519-8c81-9aa40c84d711)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=5dba1c92-c9bc-4679-a0ef-f6436bdf8f3c)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=fd57149d-c1c4-427b-b1e3-2179aaf338b2)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=418476c6-14f4-4b3a-bcbb-f26a4f1d629d)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=4711ae44-d3c9-4105-8bdc-872ed7626eec)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=d8ce2d3d-ab77-41bb-a253-259cd2da8b3f)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=1d6bf1f0-5700-4bd2-b4cc-8f4b08a9aa3a)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=dbd342e8-699f-48f5-8d38-0f11f9dec4a2)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=2af90921-5bba-4191-8703-6d9db1d431d7)